Wealth managers active in the offshore wealth management market are expecting breakneck growth, largely driven by mounting fears among HNW investors. As the pandemic enters its third year, fears of negative economic impacts are increasingly shaping investment strategies, leading to a divergency with asset allocation trends in the onshore market. Offshore investing is set for an active year in 2022.

GlobalData’s HNW Offshore Preferences Analytics has tracked a steady increase in the proportion of wealth booked offshore by HNW investors, with a growing consensus that this proportion will increase yet again in 2022. Just over three quarters of the private wealth managers that contributed their views to the data in HNW Offshore Preferences Analytics expect their HNW clients to increase the proportion of their wealth offshored (already at record highs) in 2022.

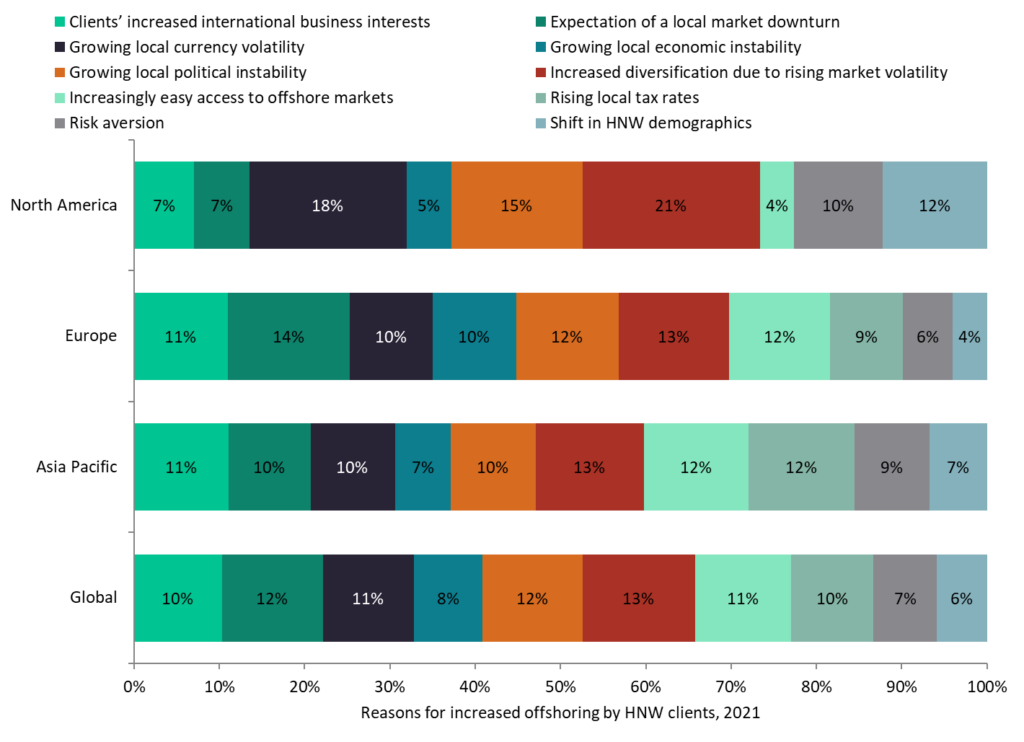

Pre-pandemic, clients’ increased international business activities was a top two driver for offshoring across all regions of the world. However, this time the results are more mixed but also more negative. Market volatility – followed closely by expected local market downturns and increased political instability – will motivate HNW investors to move their money offshore. Market volatility is of particular concern in North America, along with currency volatility, no doubt exacerbated by higher inflation. Europe – often the gloomiest of regions – is also strongly influenced by fears of market volatility. While the exact reasons vary, the overall trend is towards negative expectations for onshore investments, pushing investors to offshore financial centres.

Wealth managers need to acknowledge this defensive stance to offshore investment flows. Investments that fare best in recessions and times of uncertainty will have the greatest draw. Safe-haven assets still have some appeal to these nervous HNW investors and need to be deployed accordingly.

Why do you expect the proportion of HNW wealth offshored to increase?

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData