The Rise of ESG Investments in North America

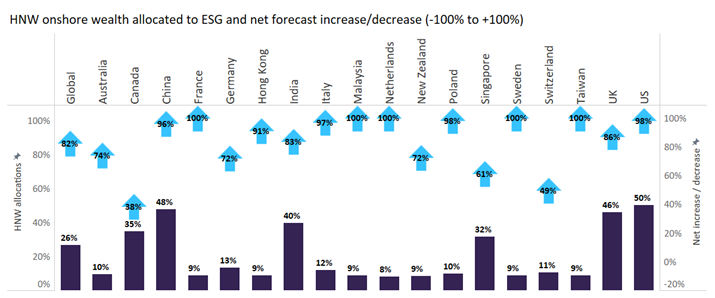

The environmental, social, and governance (ESG) theme is flourishing within the HNW space. While there are regional differences, growth can be found across the globe. While high allocations for ESG in the world’s top financial centers the UK and the US are unsurprising, as well as in North America in general, wealth managers cannot afford to ignore China.

ESG is no longer just a buzzword. The theme now has a major impact on the broader financial services industry – and the wealth management sector in particular. According to GlobalData’s 2021 Global Wealth Managers Survey, HNW investors allocate an average of 26.5% of their financial assets to ESG investment products globally. In addition, demand is far from saturated. 82.2% of wealth managers expect the proportion of financial client assets allocated to ESG investments to increase over the next 12 months.

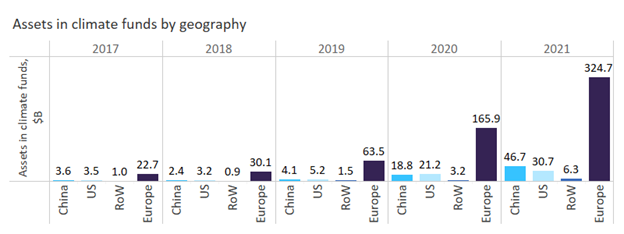

However, it is China that stands out. High ESG allocations in the UK and the US are to be expected given the maturity of the sustainable investment market in Europe and North America. On the other hand, China’s position is a touch surprising given that the country remains the world’s largest annual emitter of greenhouse gases. Yet Morningstar data shows that China overtook the US as the largest climate investment market outside Europe in 2021. Climate fund assets in China amounted to $47 billion in 2021 – a 149% increase compared to 2020.

Source: Morningstar

In particular, China has upped its game in the “environmental” category in recent years. Globally, 63.2% of businesses rate the environment as the most important ESG factor. In China, this proportion stands at 80.0% according to GlobalData’s 2021 ESG Strategy Survey.

This trend is expected to continue going forward. ESG (particularly the environmental component) is expected to gain more traction in the developing world. According to a study by Credit Suisse, Generation Z and millennial consumers in China (and other emerging economies) are more environmentally conscious than their peers in the developed world. In part, this can be attributed to the fact that they have been more exposed to the effects of global warming. Regardless of the reasons, this means wealth managers in these markets will have to put greater emphasis on environmental investment practices.

ESG investments can no longer be regarded as an add-on or a “nice to have” outside of key financial centers. Instead, they should form an integral part of a wealth manager’s service proposition across the world.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData