More so than in other segments of the financial services sector, retention and training of frontline staff is becoming an increasingly big challenge for wealth management as the effects of COVID-19 lead to permanent changes in the behaviour of firms and investors.

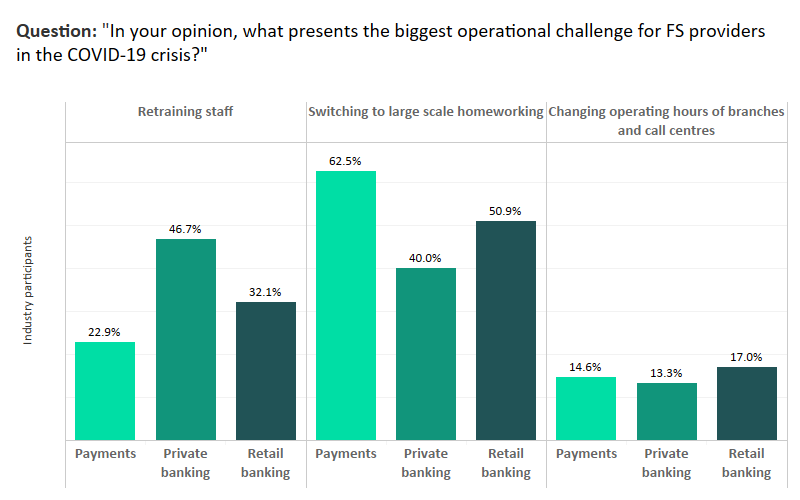

Throughout the pandemic, GlobalData has been polling financial services executives regarding the impact on their firms and lines of business. Questioned about the biggest wealth management operational challenge during the COVID-19 crisis, 46.7% of those engaged in the private banking space stated that retraining staff was their main concern. This compares to 22.9% in the cards and payments industry and 32.1% in the retail banking space according to our Q2 2021 Financial Services Industry Poll.

This challenge is not a new one, but it has been exacerbated by COVID-19. Matching the profile of the average HNW demographic, financial advisers in the private banking space tend to be in the later years of their career, with many falling into the above 50 age bracket. As a result, uptake of digital technologies remains lower than in other sectors. Indeed, our previous surveying of the market shows that almost half of wealth managers globally are concerned about the lack of digital skills among advisers.

With remote working and investment practices on the rise as a direct result of the pandemic, this has further contributed to this challenge, and we are seeing heightened competition for advisers who not only are suited for the private banking market but also digitally savvy. This makes the retention of staff with strong digital skills a key concern for wealth managers.

Data from our 2020 Global Wealth Managers Survey shows that 40.6% of wealth managers regarded the retention of their current adviser base as a threat to business growth in 2019. By 2020 – at the onset of COVID-19 – this proportion had risen to 53.6%, meaning competition for digital-savvy advisers will have increased even further.

With adviser churn rates on the rise, in addition to training, retention management must become more of a focus – not only to prevent knowledge loss but also customer churn. Given the importance of personal relationships between advisers and investors in private banking, HNW clients are likely to move on with their adviser should the latter decide to leave. This poses a significant challenge in an already competitive market. Loyalty strategies cannot solely be focused on the client. It is time to think about perks that both attract quality staff and increase employee retention. Complimentary employee Hootsuite webinars and yoga classes anyone?

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData