Even though there is a wave of antitrust moves against tech majors such as Alibaba and Tencent, venture capital (VC) investors seem to be reposing their faith in Chinese firms.

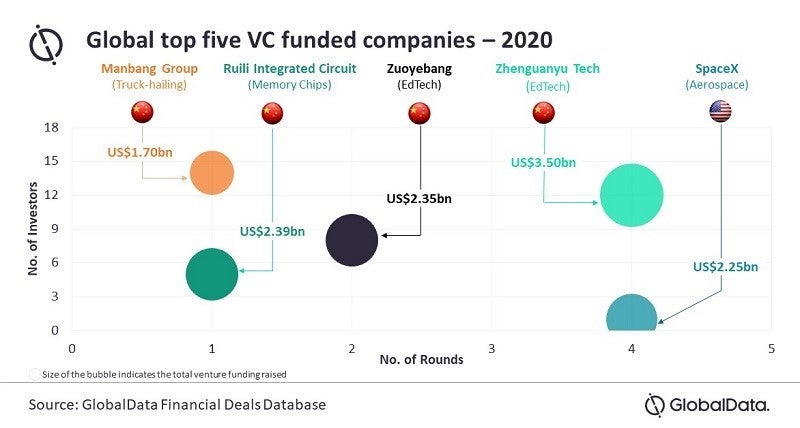

In 2020, VC investors favored edtech, aerospace, memory chips and ride-hailing. China, which has many firms working in these areas, led the list of global top five VC funded companies during the year, according to GlobalData, a leading data and analytics company.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

GlobalData revealed that out of the five top VC funded companies, four were from China in 2020. They posted a combined disclosed VC funding of $9.94bn, while the only US-based firm Space Exploration Technologies (SpaceX) had a total disclosed funding of $2.25bn.

Chinese edtech firm Zhenguanyu Tech raised $3.5bn, which is the highest VC funding among all the firms in 2020. The list also featured another Chinese edtech firm, Zuoyebang, which able to raise $2.35bn during the year.

GlobalData lead analyst Aurojyoti Bose said: “Edtech has emerged as an area witnessing renewed interest during the COVID-19 outbreak. It has been gaining significance with enhanced use of online platforms during the pandemic and no wonder companies active in this area have been successful in raising sizeable funding, which is also a testimony to the growing VC investors’ traction in this space. Companies active in memory chips and ride-hailing space are also gaining attention.”

The other China-based firms to figure in the list of top five VC funded emerging tech companies in 2020 included Ruili Integrated Circuit and Manbang Group with total disclosed funding of $2.39bn and $1.70bn, respectively. Ruili Integrated Circuit develops memory chips, while Manbang Group provides a mobile truck-hailing platform.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataBose concluded: “Huge population and increasing use of mobile technologies for education are expected to make China as an edtech hotspot. GlobalData not only foresees a continuation of these trends in 2021, but also a growing enthusiasm by foreign investors for Chinese edtech companies in the post-COVID-19 era.”