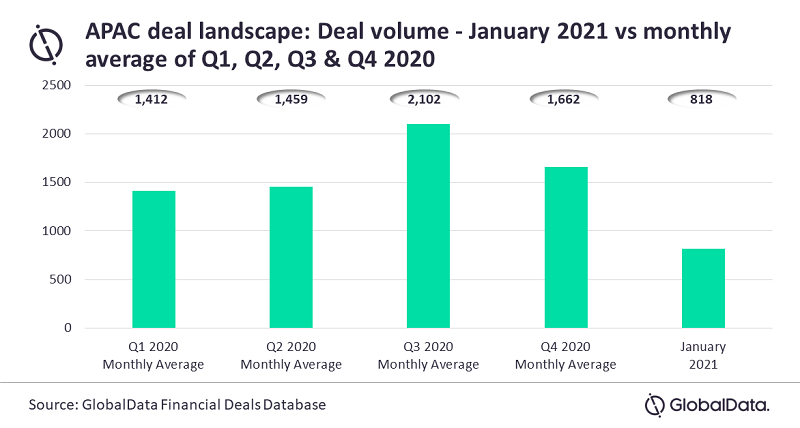

The Asia Pacific (APAC) region saw a total of 818 deals announced in January 2021, which is a fall of 42.3% over the 1,417 deals announced during the previous month, according to GlobalData, a leading data and analytics company.

An analysis of GlobalData’s Financial Deals Database shows that the deal volume during January 2021 more than halved compared to the monthly average of Q4 2020. It also stayed below the monthly average deal volume of all the other quarters in 2020.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

GlobalData lead analyst Aurojyoti Bose said: “After remaining mostly subdued during H1 2020, deal activity in the APAC region recovered sharply in Q3 2020. However, with the fear of second wave of COVID-19 looming large on some of the key markets, deal activity started declining with the onset of Q4. Moreover, the recent surge in new COVID-19 cases in key APAC markets such as China and Japan seem to be making things even worse with the deal activity in January showcasing a significant decline. This is the fourth consecutive month of decline in deal activity.”

Most of major markets in the region such as Japan, Australia, Singapore, China, Malaysia, India, South Korea and Hong Kong saw month-on-month fall in deal volume by 62.6%, 61.5%, 58.6%, 39.1%, 32.3%, 30.9%, 24.2%, and 17.6%, respectively, in January 2021.

Deal activity also indicated month-on-month decline across all deal types, beginning from private equity, merger & acquisitions (M&A), equity offerings, partnership, venture financing, licensing agreement, to debt offerings by 66.1%, 58.7%, 48.8%, 31.3%, 28.9%, 7.7%, and 5.8%, respectively.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData