After a turbulent period marked by customer backlash and regulatory scrutiny, the Australian environmental, social, and governance (ESG) market is now seeing renewed inflows into sustainable products. Wealth managers now face a critical juncture: embracing ESG is not simply about meeting client preferences—it is about staying competitive in a rapidly evolving market.

Against this backdrop, regulatory expectations are tightening, with the Australian Securities and Investments Commission (ASIC) cracking down on greenwashing as allegations have been mounting. Earlier in 2025, ASIC released further sustainable reporting guidelines, providing detailed instructions for entities required under the Corporations Act to prepare sustainability reports containing climate-related financial information. Between April 2023, and June 2024, ASIC reported 47 greenwashing interventions, such as civil penalty proceedings and infringement notices. More recently, in March 2025, the Federal Court fined Active Super A$10.5m ($6.5m) for greenwashing in a landmark case—specifically, because the provider claimed certain investments were excluded while holding them in reality. Simultaneously, as regulatory scrutiny is picking up, demand is on the rise, driven by improving investor confidence and growing trust in ESG-labelled products.

As per Betashares, net inflows for H1 2025 came in at an impressive A$21.6bn ($14.2bn), nearly double the A$11bn garnered in the first half of 2024. Meanwhile, total assets under management reached a record A$280.5bn, marking a 9% increase over the previous six months.

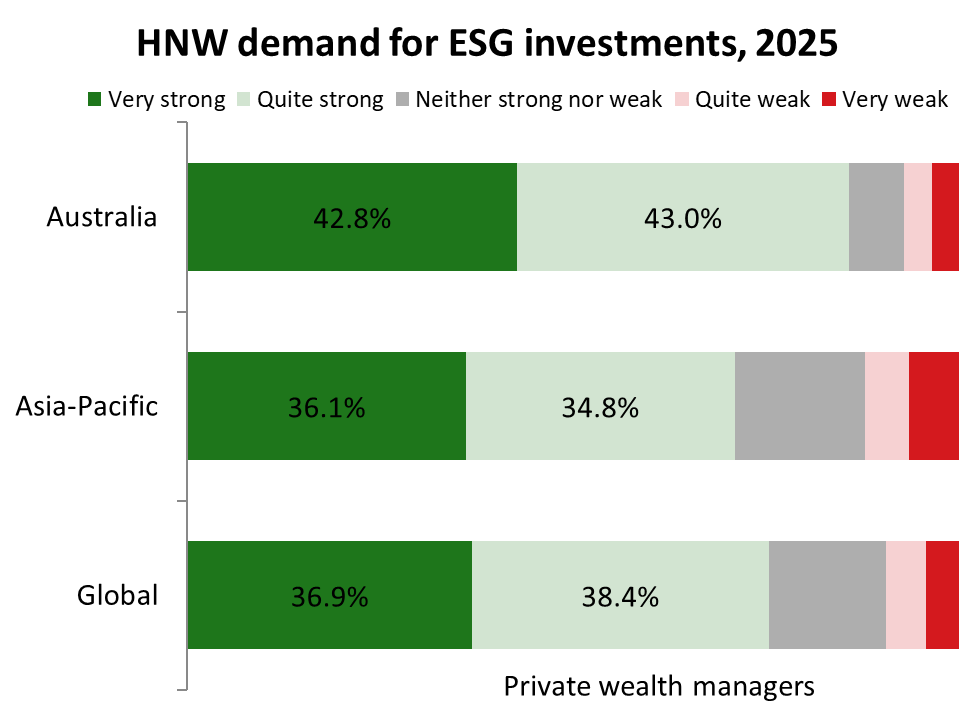

Clearly, sustainable investing is no longer a niche talking point. GlobalData’s HNW Asset Allocations Analytics 2025 found that a striking 85.8% of Australian private wealth managers report “very strong” or “quite strong” demand for ESG investments—up from 76.2% in 2024, which underscores how quickly appetite has grown. In addition, 55.3% of wealth managers expect the proportion of HNW assets allocated to ESG to increase over the next 12 months, with virtually none anticipating a decrease.

GlobalData’s HNW Asset Allocations Analytics 2025

For private wealth managers, this represents an opportunity. As sustainable investment options become standardized and sophisticated, clients will gravitate toward advisors that can offer credible, transparent ESG strategies. Offering a token “green” fund is no longer sufficient; clients and regulators alike expect transparency. Private wealth managers need to be able to block the noise coming out of the US market, where ESG has become a political issue, and focus on local market trends and regulations.

Heike van den Hoevel is Principal Analyst, Wealth Management, GlobalData

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData