Morgan Stanley and DBS are among the companies best positioned to take advantage of future Covid-19 disruption in the wealth management & private banking industry, our analysis shows.

The assessment comes from GlobalData’s Thematic Research ecosystem, which ranks companies on a scale of one to five based on their likelihood to tackle challenges like Covid-19 and emerge as long-term winners of the wealth management & private banking sector.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

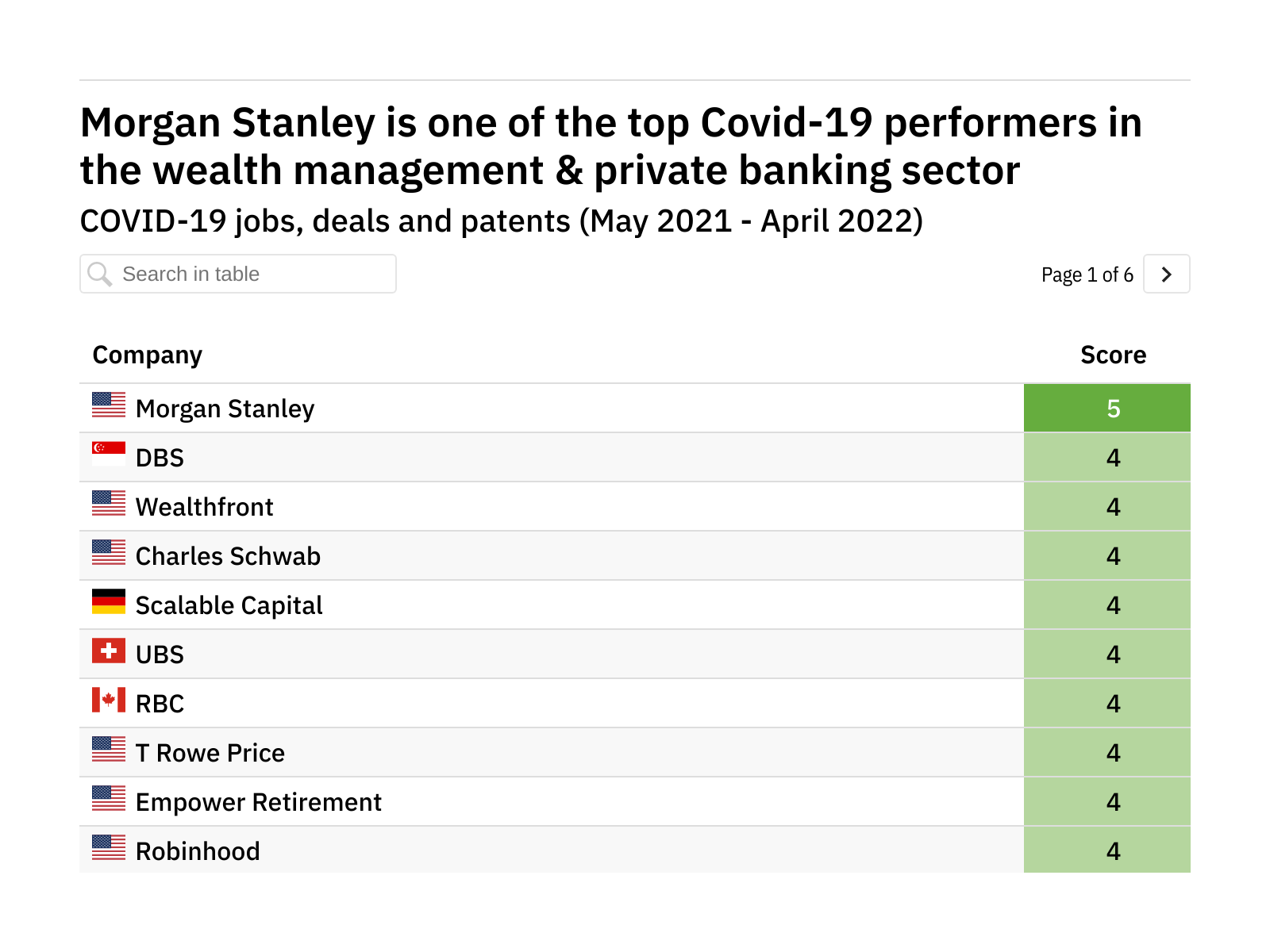

According to our analysis, Morgan Stanley is the company best positioned to benefit from investments in Covid-19, the only company with a score of five out of five in GlobalData’s Wealth Management Thematic Scorecard.

The table below shows how GlobalData analysts scored the biggest companies in the wealth management & private banking industry on their Covid-19 performance.

The final column in the table represents the overall score given to that company when it comes to their current Covid-19 position relative to their peers. A score of five indicates that a company is a dominant player in this space, while companies that score less than three are vulnerable to being left behind. These can be read fairly straightforwardly.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThis article is based on GlobalData research figures as of 06 May 2022. For more up-to-date figures, check the GlobalData website.