Private banks have gone to lengths to attract wealthy women, yet new data from WealthInsight shows female HNWIs amount to just 11% of the global high net worth population almost the same as four years ago. WealthInsight’s Oliver Williams looks at how private banks can be smarter in appealing to female HNWIs

Private banks have spent much of the last decade adapting to a new customer: the female high net worth individual (HNWI). The drive for gender equality in the workplace – and especially the boardroom – has laid rest to stuffy misconceptions of wealthy widows and divorcees. Women who now require the services of private bank or wealth manager are more likely to be self-made and successful, and there are more of them.

Harvard Business Review predicts that women will own 50% of the world’s wealth by 2020. UBS is betting on a growth in female wealth from £13trn today to $18trn by 2021 and in the intervening four years plans to do all it can to win some of that $5trn. The Swiss bank says it will balance the gender equality of its own bankers and run education programs for women illiterate in financial jargon.

Other banks are planning similar schemes – Standard Bank runs its Woman’s Wealth Academy in Johannesburg in order to make its female clients more financially savvy – while new firms have sprung up catering solely to this demographic. One of these is Ellevest, a women-centric automated investment platform founded by former a Bank of America and Citi banker. The firm’s algorithms take account of female-centric data such as salary and mortality which differ from males.

Does female-centric private banking pay?

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataWealthInsight’s latest data on global high net worth equality, the first such study since 2013, shows that the percentage of all HNWIs that are female remains steadfast at 11%. Hardly the mass demographic change banks were betting on. As the global HNWI population has grown, however, there are indeed more wealthy women since the study was conducted – another 130,000 HNW females to be precise. Though when compared to the 1.4m HNW males that have made their money in the past four years, they make slim pickings for private banks.

Look further at the data, however, and you can see a pattern of equality, a pattern which is emerging in the East. Alongside their ballooning first generational wealth, Asian countries are quickly becoming the most equal in the world. One quarter of all HNWIs in Vietnam are women, more than any other country.

Singapore and Hong Kong rank joint fifth on the countries listed the most equal in HNWIs and Asia-Pacific as a whole has a female HNW equality averaging 13%. The global average is bought down, unsurprisingly, by Middle Eastern and African countries, which collectively hover at 8%.

Asian Banks are leading the female focus

This regional trend is not unknown to a handful of innovative Asian private banks and wealth managers who appeal among female clients. HSBC Hong Kong runs its popular Women’s Forum for female HNWIs, created after a study commissioned by the bank found that female entrepreneurs in Hong Kong are wealthier than their male counterparts.

An amicably named Miss Kaya recently launched as a robo-advisory platform for wealthy women in Asia. The Singapore based firm aims to simplify financial jargon which leaves some women daunted by financial management. Another Singaporean name, DBS, boasts that it has around 10% more female bankers than men and in 2012 launched it’s ‘Woman’s World MasterCard’, in a bid to woo more wealthy women.

Do Female HNWIs demand a different private banking?

Such schemes, however, are not guaranteed formulas for attracting female HNWIs wherever they may be. According to Boston Consulting Group’s 2016 Global Wealth report, 65% of female investors switch wealth managers because of unhappiness with the service. Female forums, cards online platforms are unlikely change satisfaction with the fundamental service of a bank.

A different approach is to look at the source of wealth in order to pre-empt the services that are required by female HNWIs.

One of the findings from the WealthInsight study was that female HNWIs are more entrepreneurial than males. Almost 50 percent of female HNWIs owe their wealth to entrepreneurship compared to 47 percent of males. Far fewer made their money from a salaried position: only 31 percent ‘earned’ their wealth (implying it was mostly gained through a salary), whereas 45 percent of males made their wealth the same way. Boardroom equality is perhaps not progressing so fast.

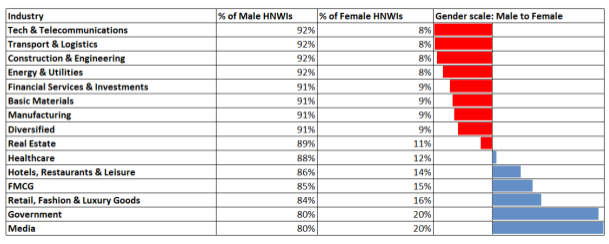

When it comes down to the industries from where money was made, the results are even starker between the genders. Financial services is still the domain of men, with 17% making their money from the sector. The largest sector for female HNWIs on the other hand is media, though financial services is still popular with 12% owing their wealth to the industry. Construction, engineering and transport stay true to their male stereotypes being the least popular sources of wealth for female HNWIs.

Future female fortunes

Private banks launching female initiatives have been right in one thing: Gender equality is changing in HNWI circles (be it at snail’s pace). Cashing in on the inevitable cash flow with schemes and gimmicks, however, is largely missing the point. As with private banking of any orientation, there is never a one-size-fits-all approach. Bankers need to look at where the wealth comes from in order to manage where it is going.